Certificate of Eligibility by FBR

New Definition introduced as per Budget 2025-26 FBR has launched certificate of Eligibility by FBR for the purchase of Property and Vehicle. Now every taxpayer is required to get this certificate before making any purchase.

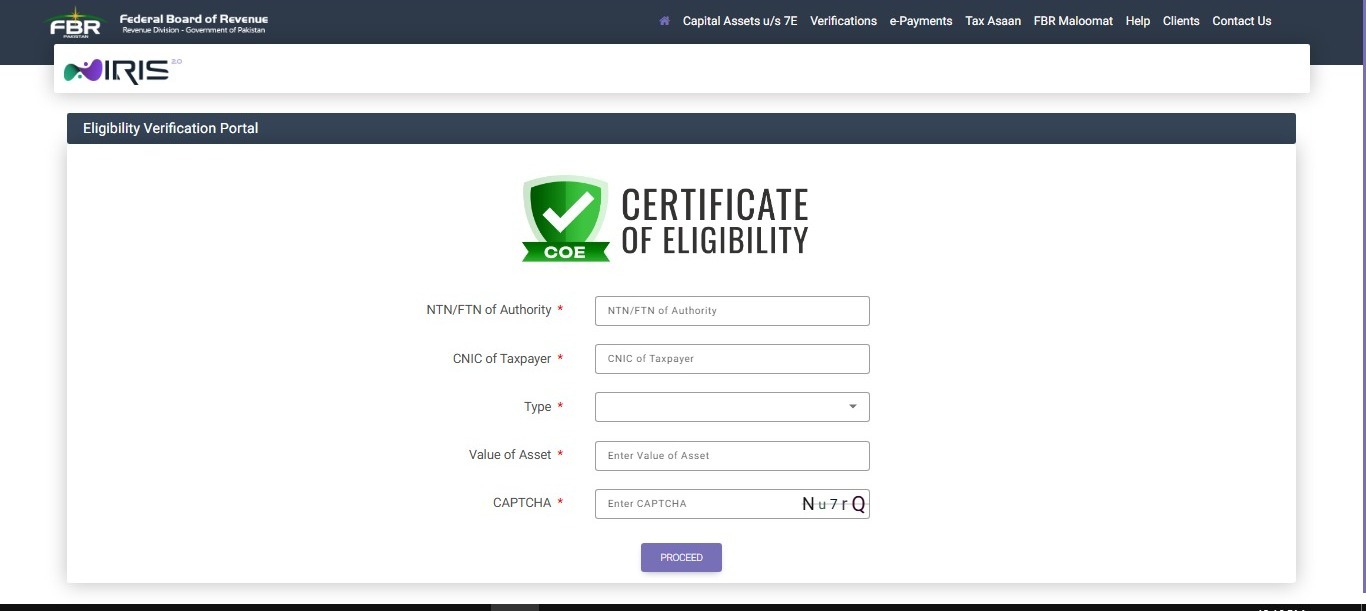

The Federal Board of Revenue (FBR) has implemented a “Certificate of Eligibility” feature in its IRIS tax portal to enforce new regulations from the Finance Bill 2025-26. This measure restricts the purchase of high-value vehicles and properties to “eligible persons” only.

To qualify as eligible, an individual or entity must have filed the previous year’s tax return and declared sufficient resources in their wealth or financial statements to justify the purchase, as stipulated in the proposed Section 114C of the Income Tax Ordinance, 2001.

Compliant taxpayers can now instantly generate this digital certificate, which will be mandatory for vehicle and property registration authorities. This initiative is a key part of FBR’s digital strategy to combat tax evasion, prevent the use of undeclared wealth, and broaden the tax base.

Frequently Asked Questions on Certificate of Eligibility by FBR

- What is the FBR’s new “Certificate of Eligibility”? It is a digital certificate available on the FBR’s IRIS portal that proves a person is compliant with tax laws and therefore permitted to purchase property and vehicles above a certain value.

- Why was this certificate introduced? It enforces a new rule in the Finance Bill 2025-26 designed to ensure that only active taxpayers can make high-value purchases.

- Who is considered an “Eligible Person”? According to the proposed Section 114C of the Income Tax Ordinance, 2001, you are eligible if you meet two conditions:

- You have filed your income tax return for the previous tax year.

- You have declared sufficient funds in your wealth or financial statements to cover the cost of the purchase.

- How will this system work in practice? An eligible taxpayer will generate the certificate from the IRIS portal. This certificate must then be presented to registration bodies (like the Excise department for cars or property registrars) to complete the transaction.

- What happens if I am not eligible? You will be barred from purchasing vehicles and property that exceed a specific value threshold, which will be announced by the government.

- What is the overall goal of this policy? The FBR aims to increase transparency, curb the use of undeclared money in the real estate and auto sectors, and expand the number of active taxpayers in Pakistan.

Key Takeaways in Bullet Points

- New Feature: FBR has added a “Certificate of Eligibility” button to its IRIS online portal.

- Purpose: To restrict the purchase of high-value property and vehicles to compliant taxpayers only, as per the Finance Bill 2025-26.

- Eligibility Requirements: To be eligible, a person must:

- Have filed an income tax return for the previous year.

- Have declared sufficient wealth/resources to justify the purchase.

- Legal Basis: The rules are defined under the new Section 114C of the Income Tax Ordinance, 2001.

- Process: Eligible taxpayers can instantly generate the digital certificate to present to registration authorities (e.g., Excise & Taxation, property offices).

- Primary Goal: To combat tax evasion in the real estate and automotive sectors, document the economy, and increase national revenue.